You are accruing a pension at Astellas Pension Fund. As of 2015, your pension fund has an average salary scheme. The scheme is also referred to as a CDC scheme (collective defined contribution) or benefit agreement. When you retire, you will receive a monthly pension benefit from this scheme. The annual accrual rate for your pension for 2022 has been set at 1.37%, compared with 1.47% in 2021.

Your pension accrual will be 1.37% in 2022

The partners in the collective labour agreement – i.e. the employer, the trade unions, and the Works Council – have entered into agreements regarding a fixed pension contribution paid by you and your employer. The accrual percentage which can be granted on the basis of this contribution is calculated each year. Further information about the determination of the contributions and the accrual percentage can be found on the website on this page

Based on the pension contribution paid to the fund, the Board of the Astellas Pension Fund can grant accrual of 1.37% for 2022. That means you will accrue slightly less pension in 2022 than in 2021. To illustrate what the lower accrual rate means for you, we have provided an example calculation below.

|

|

2022 |

2021 |

|

Annual pensionable salary |

€50,000 |

€50,000 |

|

Deductible* |

€15,860 |

€15,584 |

|

Pension base |

€34,140 |

€34,416 |

|

Accrual percentage |

1.37% |

1.47% |

|

Annual pension accrual |

€468 |

€506 |

* The deductible is the amount over which you do not accrue pension because you also receive state pension (AOW).

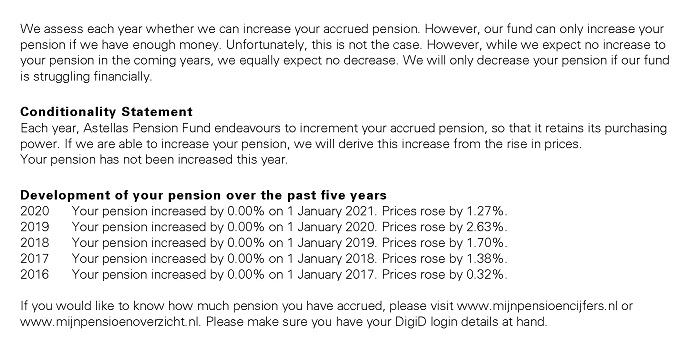

No increase to your accrued pension

As money usually becomes worth slightly less each year, we try to increase the pension you already accrued each year (we call this indexation or pension supplementation). The policy coverage ratio presents the fund's financial position. The policy coverage ratio also indicates whether we can increase your pension. Unfortunately, our policy coverage ratio does not allow for an increase in 2022. This means that, for the time being, your accrued pension will not be increased as of 1 January 2022. On the other hand, no reduction is required.

The rules for pension funds with regard to increasing pensions may be changed in the course of 2022. The Board of your pension fund attentively follows the developments of the rules. If these developments may affect your pension, we will inform you of this.

Where to find more information

- On this website. The pension regulations are listed in the ‘documents’ section. You can request a copy of the pension regulations from us.

- For detailed information on the pension you have accrued so far, please log in to Mijn Pensioencijfers (My Pension Figures). You can log in with your DigiD. Verify whether your expected pension age is right for you. If this is not the case, then you can only take extra action in a private capacity.

- An overview of all the pension you have accrued thus far, including your state pension (AOW), is listed on www.mijnpensioenoverzicht.nl. You can log in with your DigiD.

- You can view the consequences of the reduced accrual percentage on the Uniform Pension Overview concerning 2022, which you will receive from us in 2023.

Do you have any questions?

Please contact us. We would be pleased to help you.

Are your data still up to date?

By logging into Mijn Pensioencijfers (My Pension Figures), you can check your personal data and change them if necessary. Please also submit your e-mail address. We prefer communicating digitally with you.

Nederlands

Nederlands