Purchasing a pension in the average earnings scheme

-

Can I purchase a pension in the average earnings scheme?

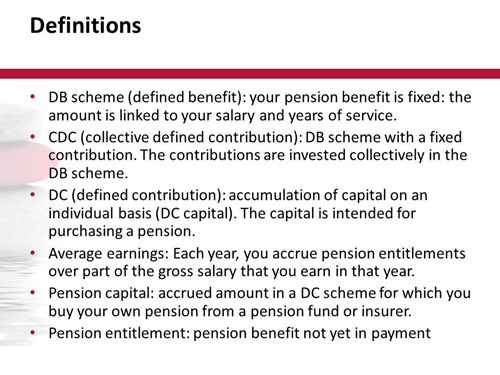

If you have previously accrued pension capital in the Astellas Pension Fund defined contribution (DC) scheme, you can choose each year to use your DC-capital to purchase a pension in the fund’s average earning scheme. You will receive a letter about this.

-

How do I know if I have accrued capital in the defined contribution scheme?

If you are a member of the defined contribution (DC) scheme, you will find the accrued amount in your Uniform Pension Overview (UPO). You can download your latest pension overview from Mijn Pensioencijfers (My Pension Figures), the secure environment of the Astellas Pension Fund. You can log in with your customer number.

-

When can I purchase a pension in the average earnings scheme?

Each year, the pension fund will send you a letter about this option and specify the period within which you must make a choice.

-

How can I purchase a pension in the average earnings scheme?

You will receive a letter about this option. If you choose to use your DC-capital to purchase a pension in the average earnings scheme, you must complete the corresponding form and ensure that the form is returned to the pension fund within the specified period.

-

How often can I purchase a pension in the average earnings scheme?

You can only choose once a year to use your DC-capital to purchase a pension in the Astellas Pension Fund average earnings scheme. Once made, that choice can no longer be reversed.

Each year, you will receive a letter about the option of using your DC-capital to purchase a pension in the average earnings scheme. Once you have made the choice to use your DC-capital to purchase a pension, you will no longer receive the letter giving you this opportunity.

-

Must I use my pension capital from the defined contribution scheme to purchase in the average earnings scheme?

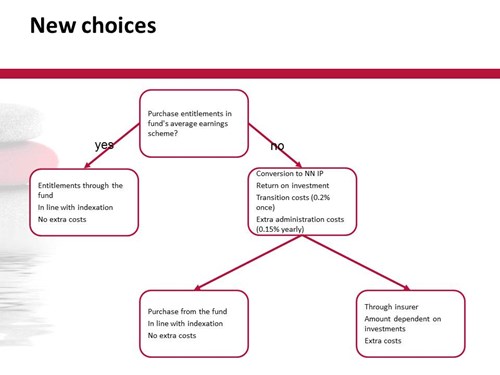

No. You decide for yourself whether and in which year you wish to use your pension capital from the defined contribution (DC) scheme to purchase in the average earnings scheme. If you choose not to do that, you can:

- use the capital to purchase extra retirement pension on your retirement date;

- use the capital to retire before your retirement date;

- transfer your pension capital to a new employer if you change employers.

-

What conditions are attached to purchasing a pension in the average earnings scheme?

- You decide for yourself whether and in which year you wish to use your DC-capital to purchase a pension in the average earnings scheme.

- The choice to purchase a pension in the average earnings scheme is made once only.

- The choice to purchase a pension in the average earnings scheme is irrevocable.

-

What risks do I run if I purchase in the average earnings scheme?

Several considerations can be taken into account in your purchasing decision:

- In weak financial circumstances, the pension fund may reduce the granted pension entitlements in the average earnings scheme.

- The return on the investment in the fund in the defined contribution (DC) scheme may be very positive in a given year. You will lose out on that if you purchase in the average earnings scheme.

- The purchasing factors for pensions are adjusted annually. These factors may change (increase of decrease) depending on e.g. interest rates and life expectancy.

- If interest rates fall, the fund must keep more money in its coffers in order to be able to pay out pensions now and in the future. This adversely affects any increases of your pension entitlements.

- Future legislative amendments may have negative consequences for your pension accrual in the average earnings scheme.

-

What may happen if I do not purchase a pension in the average earnings scheme?

- In strong financial circumstances, the pension fund may increase the granted pension entitlements in the average earnings scheme.

- The return on investment in the fund in the defined contribution (DC) scheme may be very negative in a given year. This would not affect you if you purchase in the average earnings scheme.

- The purchasing factors for pensions are adjusted annually. These factors may change (increase or decrease) depending on e.g. interest rates, life expectancy.

- If interest rates increase, the fund does not need to keep as much money in its coffers in order to be able to pay out pensions now and in the future. This positively affects any increases of your pension entitlements.

- Future legislative amendments may have positive consequences for your pension accrual in the average earnings scheme.

-

What happens if I retire?

If you choose to leave your pension capital in the defined contribution (DC) scheme, you can use that capital on your retirement date for extra retirement pension, or before your retirement date to retire earlier.

-

What happens if I leave my employment?

If you leave the company, you can opt to do the following in respect of your pension capital in the defined contribution (DC) scheme:

- transfer it to your new employer (value transfer); or

- leave it with the Astellas Pension Fund, managed by NN IP.

-

How will I be informed about purchasing a pension in the average earnings scheme?

As long as you have pension capital in the defined contribution (DC) scheme, you will receive a letter each year from us with the option to use that capital to purchase a pension in the average earnings scheme.

-

Two terms are used in Dutch in relation to this scheme: beschikbare premieregeling and DC-regeling. What is the difference?

The terms are synonymous. Beschikbare premie means defined contribution and DC stands for defined contribution in English.

-

My question is not covered here.

You can always contact us for more information.

-

I need help.

You can always contact us for more information.

Nederlands

Nederlands