On the website mijnpensioenoverzicht.nl and in your Uniform Pension Overview (UPO), you will see an estimate of your pension in case of positive and negative future developments.

What does the estimate look like?

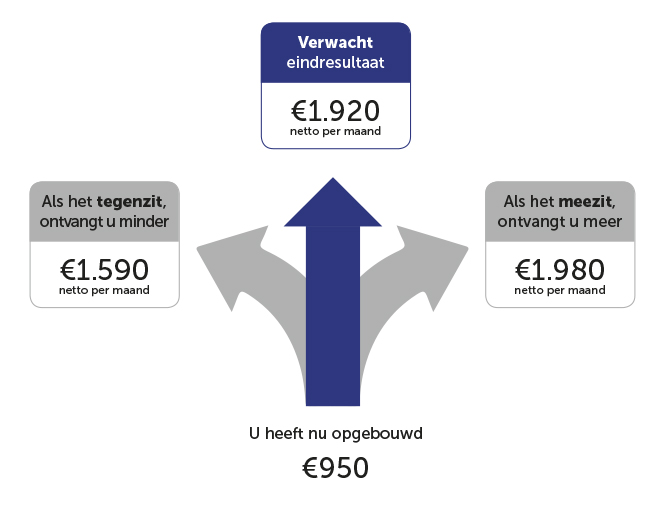

You will see your estimated pension along with three arrows, originating together from one point. An example is shown below.

You can also watch the animation by the Federation of the Dutch Pension Funds (Pensioenfederatie), which provides a useful explanation of these scenarios:

The bottom amount

The bottom amount is not an estimate. This is the pension that you have accrued to date. If you stopped accruing pension right now, this is the gross amount you would receive each year, for the rest of your life. On mijnpensioenoverzicht.nl, this amount is calculated as if you made your pension become payable at the same time as your state pension.

The upper amounts

At the top, you will see three amounts. These amounts are an estimate of the pension you would appear to end up with in various situations. With all three amounts, a key assumption is that you will continue to work until you reach the target retirement age of our fund (68) and will continue accruing pension within the current pension scheme. If you stop working sooner, you will have a smaller pension.

A great many different future scenarios have been devised. In some of these, the developments are more favourable than expected when it comes to interest, the investment performance and price increases. In others, these are less favourable than expected. All pension funds and insurers perform calculations on the basis of the same scenarios. We calculated how large your pension would be in each of these scenarios.

-

The expected final result

This is shown at the top centre. This is the pension which you would currently appear to end up with. At this time, there is a 50% chance that your pension will be smaller and a 50% chance that your pension will be bigger than this amount. -

If things go better than expected

Next to the right-hand arrow, you will see the amount that you would appear to end up with if the economy performs much better than expected. At this time, there is little chance (5%) of you ending up with a larger amount than indicated on the right. -

If things go worse than expected

Next to the left-hand arrow, you will see the amount that you would appear to end up with if the economy performs much worse than expected. At this time, there is also little chance (5%) of you ending up with a smaller amount than indicated on the left.

What causes things to go better or worse than expected?

-

The interest rate

When the interest rate rises, less reserves need to be maintained by our fund for the future and it is more likely that we will be able to increase the pensions. Conversely, when the interest rate falls, more reserves need to be maintained. In that case, it becomes less likely that we will be able to increase the pensions. -

Investments

We invest the contributions for your pension. We cannot opt only to save these, because that would not generate enough money to be able to pay out all of the pensions now and in the future. However, investing is not risk free. We do not know in advance exactly how much money the investments will generate. In certain periods, the income may be low, or there may even be a loss on the investments. In the latter case, it is possible that we would have to reduce the pensions. -

Price increases or decreases

If the prices increase, the value of your pension will decrease. That is because you will not be able to buy as much with the same amount of money. We took the effect of prices on how much you will be able to purchase with your pension in future into account in the estimation. The amount that you are expected to receive is therefore an adjusted amount. If the prices are expected to increase, the amount is adjusted downward (slightly).

What else can impact your pension?

Changes in your personal or job situation may also have consequences for your pension. Examples include a higher or lower salary or a divorce. We have not taken possible changes in your personal or job situation into account.

Difference between Mijnpensioenoverzicht.nl and UPO

In the Uniform Pension Overview (UPO) you will receive from us this year, you will see this estimate of your pension in case of positive and negative future developments for the first time. You will see an estimate of the pension that you will receive from our fund. If you log in on mijnpensioenoverzicht.nl, you will see an estimate based on your total pension, i.e. including any other pension funds and your state pension.

Have you already retired?

Then you will also see your estimated pension in case of positive or negative developments in the coming ten years on mijnpensioenoverzicht.nl. You will see this estimate starting from the date on which you begin receiving your state pension (AOW). As long as you do not yet receive state pension, your pension will be shown as if it started being paid out at the same time as your state pension.

If your expected final result is less than the amount you currently receive, that means that economists expect prices to increase and that the purchasing power of your pension will decrease. So you will not receive less money, but you will not be able to buy as much with the same pension. Based on the expected final result, you can imagine how much you will be able to purchase with your pension ten years from now.

Nederlands

Nederlands